What is Silver?

What is Silver? Silver is a chemical element with the symbol Ag (from the Latin Argentum) and atomic number 47. It is a soft, white, lustrous metal that is highly conductive to electricity and has a high thermal conductivity.

Silver has been used for thousands of years for decorative, ceremonial, and practical purposes, including jewelry, coins, tableware, and electrical components. It is also used in photography, medicine, and as a catalyst in chemical reactions.

Silver is found in nature as a pure metal or in various minerals, including argentite, chlorargyrite, and galena. It is often obtained as a byproduct of mining other metals, such as lead, zinc, and copper.

Brief History of Silver

Silver has been used by humans for thousands of years, with archaeological evidence suggesting that it was first mined and used for decorative purposes in Anatolia (modern-day Turkey) around 4000 BC. Throughout history, silver has been valued for its rarity, beauty, and practical uses.

In Ancient Times

Silver was used for currency, and it played a significant role in the economies of many civilizations, including the Greeks, Romans, and Chinese. The Spanish conquistadors also brought large quantities of silver from the New World to Europe in the 16th and 17th centuries, which helped fuel the global economy and played a significant role in the development of international trade.

During the Industrial Revolution

The demand for silver increased dramatically as it became an important component in the manufacturing of photographic film, mirrors, and electrical components. Silver was also used as a standard for currency until the early 20th century when it was replaced by fiat currencies.

In Modern Times

Today, silver is used in a wide range of applications, including jewelry, coins, silverware, electronics, medicine, and solar panels. It is also a popular investment commodity and is traded on global exchanges. Despite its long history, silver continues to be a valuable and versatile metal with a wide range of uses.

What is Silver Used For?

Silver is a highly versatile metal that is used in a wide range of applications, both practical and decorative. Some of the most common uses of silver include:

Investment

Silver can be a popular investment option for those looking to diversify their portfolio and hedge against inflation. As a precious metal, it has traditionally been seen as a safe haven investment, similar to gold. The value of silver is influenced by a variety of factors, including global economic conditions, geopolitical events, and supply and demand dynamics.

Jewelry

Silver is a popular material for making jewelry, including rings, necklaces, earrings, and bracelets. It is highly durable, easy to work with, and has a bright, shiny appearance that makes it a popular choice.

Silverware

Silver is used to making cutlery, dishes, and other tableware items. It is highly resistant to corrosion and tarnishing, making it ideal for use in the kitchen and dining room.

Electronics

Silver is used in a variety of electronic components, including switches, relays, and circuit breakers. It is an excellent conductor of electricity, making it ideal for use in high-tech applications.

Photography

Silver is used in the production of photographic film and paper. When exposed to light, silver particles on film and paper undergo a chemical reaction that produces a photographic image.

Medicine

Silver has antibacterial properties and is used in some medical applications, including wound dressings and surgical instruments.

Solar panels

Silver is used in the production of solar panels. It is a highly efficient conductor of electricity and is used in the production of photovoltaic cells.

Coins

Silver has been used as a currency for centuries and is still used today in the production of commemorative coins and bullion.

These are just a few examples of the many applications of silver. Its versatility, durability, and beauty have made it a valuable material in a wide range of industries.

How to Invest in Silver?

Before investing in silver, it’s important to do your research and understand the risks involved. The value of silver can be volatile and can fluctuate based on economic and political factors. It’s also important to have a diversified investment portfolio. There are several ways to invest in silver, including:

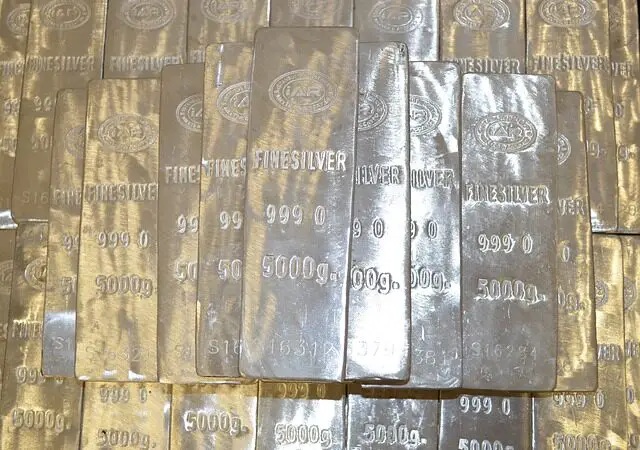

Physical silver

You can purchase physical silver in the form of coins, bars, or rounds. This allows you to own the actual metal, which can be stored in a safe or vault. You can purchase physical silver from precious metals dealers, coin shops, or online retailers.

Exchange-traded funds (ETFs)

ETFs are investment funds that trade on stock exchanges like a stock. Silver ETFs allow you to invest in silver without owning the physical metal. These funds typically hold silver bullion or futures contracts.

Futures contracts

Futures contracts allow you to buy or sell silver at a set price on a future date. This is a speculative investment that requires a good understanding of the silver market.

Mining stocks

Investing in mining companies that produce silver can be another way to gain exposure to the silver market. However, investing in mining stocks can be risky as they are subject to factors such as production costs, geopolitical events, and mining accidents.

Bullion coins and bars

You can invest in silver bullion coins and bars, which are made of at least 99.9% pure silver. These can be purchased from dealers or banks, and the value is based on the spot price of silver.

What Are the Risks of Investing Silver?

Like any investment, investing in silver carries some risks. So it’s important to understand these risks and to have a diversified investment portfolio that includes a mix of assets, including stocks, bonds, and other commodities. It’s also important to do your research and understand the silver market and the factors that can affect its price. Below is a list of some of the risks associated with investing in silver.

Market volatility: The price of silver can be highly volatile and subject to fluctuations based on economic and political factors, supply and demand, and other market conditions.

Storage and security: If you choose to invest in physical silver, you’ll need to store it securely to protect your investment. This can be costly, and there is always a risk of theft or loss.

Counterparty risk: If you invest in silver ETFs or futures contracts, you are relying on the issuer or counterparty to deliver on their obligations. There is always a risk that the issuer or counterparty may default.

Inflation risk: Inflation can erode the value of your investment over time. While silver can be a hedge against inflation, it is not immune to inflationary pressures.

Mining risk: If you invest in mining companies that produce silver, you are subject to the risks associated with mining, including accidents, production costs, and geopolitical events.

Liquidity risk: If you need to sell your silver investment, there may not be a buyer available at a fair price. This can make it difficult to sell your investment in a timely manner.

The Importance of Silver in Society

Silver has played an important role in society for thousands of years. It has been used as currency, a decorative material, and an industrial metal. Its unique properties, including high thermal and electrical conductivity, ductility, and reflectivity, have made it a valuable material in a wide range of applications.

Today, silver is used in a variety of industries, including electronics, medicine, solar energy, and photography. It is also a popular investment commodity, and its price can be a barometer of economic conditions. Silver has not only played a significant role in shaping human history but also continues to be a crucial metal in our modern world, with its importance expected to grow as technology advances and demand for renewable energy increases.